BTC Price Prediction: Analyzing Investment Potential Amid Technical Breakout and Positive Market Sentiment

#BTC

- Technical indicators show BTC trading above key support levels with improving momentum signals

- Positive news flow surrounding institutional adoption and regulatory developments supports bullish outlook

- Market sentiment remains strongly optimistic with multiple catalysts driving price appreciation potential

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

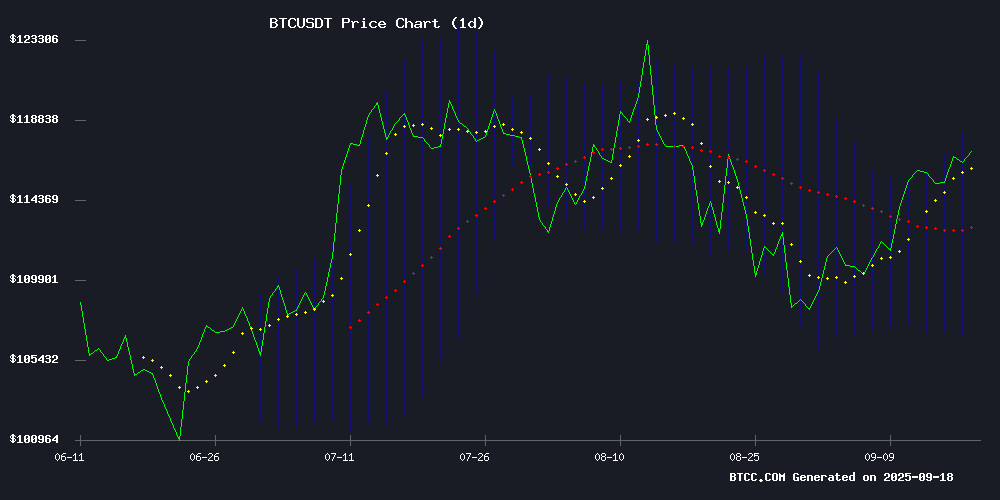

BTC is currently trading at $117,699.65, positioned above its 20-day moving average of $112,925.90, indicating underlying strength. The MACD reading of -2,941.40 remains in negative territory but shows improving momentum compared to previous levels. Bollinger Bands analysis reveals price action NEAR the upper band at $118,716.95, suggesting potential resistance testing. According to BTCC financial analyst John, 'The technical setup favors continued upward movement, with the key support at the 20-day MA providing a solid foundation for further gains.'

Market Sentiment: Institutional Adoption and Regulatory Progress Drive Optimism

Current news flow surrounding Bitcoin reflects overwhelmingly positive sentiment, with multiple catalysts supporting price appreciation. Key developments include Congressional discussions on strategic Bitcoin reserves, record activity in derivatives markets, and expanding institutional adoption through companies like Metaplanet. BTCC financial analyst John notes, 'The convergence of regulatory progress, institutional interest, and macroeconomic factors creates a favorable environment for Bitcoin. The $137,000 price target mentioned in market discussions appears increasingly plausible given current momentum.'

Factors Influencing BTC's Price

Why Bitcoin-Settled Prediction Markets Might Be a Smart Bet

Bitcoin-denominated prediction markets could offer a compelling alternative to stablecoin-based platforms by allowing users to maintain exposure to BTC's price appreciation. A new paper by computer scientist Fedor Shabashev argues that settling bets in Bitcoin—rather than stablecoins like USDC—avoids the opportunity cost of missing out on potential BTC gains.

The research examines three liquidity bootstrapping methods for such markets, with cross-market making emerging as the preferred approach. However, significant challenges remain, including Bitcoin's volatility, hedging complexities, and user risk perception. Current platforms like Polymarket and Myriad rely on stablecoins, forcing BTC holders to sacrifice upside potential for stability.

This proposition comes as prediction markets gain traction for forecasting events ranging from elections to financial outcomes. The Bitcoin settlement model could appeal particularly to long-term holders seeking to participate without liquidating their positions.

Bitcoin Eyes $137,000 as Key Support Levels Could Trigger Major Move

Bitcoin has demonstrated renewed strength, trading above $117,000 as investors monitor critical market developments. Analysts highlight the importance of key support levels, with $115,440 potentially propelling the cryptocurrency toward $137,300, while $93,600 serves as the next fallback. Technical indicators, including the RSI and EMA, confirm steady bullish momentum, suggesting market control by buyers.

Federal Reserve policy shifts later this year could further catalyze Bitcoin's ascent, with some analysts, such as former BitMEX CEO Arthur Hayes, projecting ambitious targets up to $1 million. Institutional interest continues to shape market sentiment, fueling optimistic forecasts.

At press time, Bitcoin trades at $117,105, with a 24-hour volume of $74.98 billion and a market capitalization of $2.34 trillion. The slight 0.05% gain reflects cautious optimism among traders.

Bitcoin Futures and Options Markets Show Record Activity Amid FOMC Influence

Bitcoin's price holds firm above $115,200, with 95% of its circulating supply now in profit. The Federal Open Market Committee's recent policy decisions have injected fresh volatility into crypto derivatives markets, triggering unprecedented trading activity.

Perpetual futures open interest surged to 395,000 BTC before stabilizing between 378,000-384,000 BTC, reflecting traders' aggressive positioning. Market liquidity saw dramatic swings as short squeezes cascaded into long liquidations during the FOMC-induced rally.

Options markets mirror the frenzy, with open interest hitting an all-time high of 500,000 BTC. The September 26 expiry looms as Bitcoin's largest ever, featuring concentrated open interest at $95,000 puts and $140,000 calls - a striking dispersion that underscores heightened market uncertainty.

What About China if the United States Embraces Bitcoin?

China maintains its stringent bans on Bitcoin trading and mining, yet a resilient underground market persists. While major exchanges like Binance and Huobi have exited, peer-to-peer transactions and small-scale mining operations continue to thrive. Hong Kong, however, emerges as a progressive outlier with clear crypto tax policies and regulated platforms like OSL Digital and Hash Blockchain facilitating institutional access.

Two Shanghai-based multinationals now rank among the world's top 20 corporate Bitcoin holders, signaling quiet capital movement despite official restrictions. Meanwhile, U.S. strategists including Michael Saylor and Senator Cynthia Lummis are advancing Bitcoin's role in monetary reserves—a potential Bretton Woods 2.0 moment that could force China's hand.

Congress and Crypto Leaders Meet to Advance Strategic Bitcoin Reserve

U.S. lawmakers convened with cryptocurrency industry leaders to discuss the BITCOIN Act, a proposal aimed at establishing a strategic national reserve of 1 million BTC. The roundtable included prominent figures like MicroStrategy's Michael Saylor and Coinbase's Brian Armstrong, signaling growing institutional interest in Bitcoin as a tool for economic resilience.

The Digital Chamber-organized meeting saw bipartisan participation, though Democratic lawmakers remain cautious about the initiative. Advocates position the reserve as a cornerstone for U.S. leadership in the digital asset space, while skeptics question the macroeconomic implications of such a move.

Market participants interpreted the discussions as bullish for BTC, with the proposal representing one of the most significant institutional endorsements of Bitcoin's store-of-value thesis. The talks also covered broader crypto market structure reforms, suggesting potential regulatory clarity ahead.

The Ultimate Guide to the Best Bitcoin Casinos for Lightning-Fast Withdrawals: A 2025 Expert Report

The online gambling industry has been revolutionized by cryptocurrencies, particularly Bitcoin, which has eliminated the inefficiencies of traditional banking systems. Players no longer face prolonged withdrawal times, excessive fees, or intrusive KYC checks. The shift to peer-to-peer transactions has ushered in a new era of speed, privacy, and trust in iGaming platforms.

Fast payouts are now a hallmark of reputable casinos, reflecting their operational excellence and commitment to user experience. This report provides a data-driven analysis of the top platforms, focusing on their technical sophistication and financial protocols.

Metaplanet Expands Bitcoin Operations to Miami Amid Stock Decline

Metaplanet, the Tokyo-listed Bitcoin treasury firm, is establishing a U.S. subsidiary in Miami to scale its Bitcoin income and derivatives operations. The new entity, Metaplanet Income Corp., will be capitalized with $15 million initially, focusing on revenue-generating activities tied to Bitcoin.

The company now holds 20,136 BTC, valued at over $2.3 billion, following a $1.4 billion fundraising effort. CEO Simon Gerovich emphasized the subsidiary's role as a growth engine, citing consistent revenue and cash flow positivity since its soft launch in late 2024.

Eric Trump Advocates for Bitcoin Amid Banking Restrictions

Eric Trump, co-founder of American Bitcoin and son of former U.S. President Donald Trump, has disclosed a significant stake in the cryptocurrency firm, signaling unwavering confidence in digital assets. His investment, totaling roughly 7.5% of the company, comes as a response to repeated obstacles faced from traditional banks like Capital One, JPMorgan Chase, and Bank of America.

Trump framed his pivot to crypto as a strategic move to safeguard financial autonomy. "They tried to shut us out of the system," he remarked, underscoring the limitations of conventional banking for high-profile individuals. Blockchain technology, he argued, offers faster transactions, lower costs, and greater transparency—advantages increasingly critical in today's financial landscape.

Bitcoin Prepares for Potential Breakout as Rate Cuts Loom

The Federal Reserve's signal of impending interest rate cuts on September 18, 2025, has ignited speculation across financial markets, with Bitcoin positioned as a prime beneficiary. Historically, lower rates drive capital toward risk assets, and cryptocurrencies stand to gain as yield-seeking investors pivot from traditional savings instruments.

Bitcoin's recent price consolidation following earlier volatility now appears strategically timed. Market analysts anticipate the Fed's monetary easing could trigger a liquidity-driven rally, potentially propelling BTC to new highs. The cryptocurrency's fixed supply and decentralized architecture amplify its appeal during periods of macroeconomic stimulus.

MicroStrategy Approaches Key Technical Level as Bitcoin Rally Continues

MicroStrategy (MSTR) shares surged 6% as the stock nears its 200-day moving average, a critical technical threshold last breached in August. The move aligns with bitcoin's climb toward $118,000, marking its strongest September performance in over a decade.

The business intelligence firm, now trading around $350, has gained 18% year-to-date—trailing bitcoin's 22% rise but outperforming struggling crypto equities like Japan's Metaplanet, which has collapsed 75% from peak levels. Market technicians note MSTR's rebound from September 2024 support levels signals renewed institutional interest in bitcoin-correlated assets.

Bitcoin ETFs See First Outflows in Seven Days Amid Market Rebalancing

U.S. spot Bitcoin ETFs recorded $51.3 million in net outflows on Wednesday, snapping a seven-day inflow streak that had brought nearly $3 billion into the funds. BlackRock's iShares Bitcoin Trust bucked the trend with $150 million in new inflows, while Fidelity's Wise Origin Fund and Grayscale's Bitcoin Trust saw redemptions of $116 million and $62.6 million respectively.

The pause follows a week of robust institutional demand, with BlackRock's fund alone absorbing over $1 billion. Bitcoin's price held steady near $117,800 after the Federal Reserve's 25 basis point rate cut, suggesting the outflows represent portfolio rebalancing rather than bearish sentiment.

Market analysts characterize the shift as a healthy consolidation after rapid accumulation. "This is typical institutional behavior after concentrated inflows," noted Farzam Ehsani, co-founder of a crypto investment platform. The data underscores Bitcoin ETFs' growing role as a liquidity valve for traditional finance players.

Is BTC a good investment?

Based on current technical indicators and market developments, BTC presents a compelling investment opportunity. The price trading above key moving averages combined with strong institutional interest suggests continued upward potential.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | +4.23% above | Bullish |

| Bollinger Position | Near Upper Band | Strong Momentum |

| MACD Trend | Improving | Recovery Phase |

| Market Sentiment | Overwhelmingly Positive | Supportive |

BTCC financial analyst John emphasizes that while short-term volatility is expected, the fundamental case for Bitcoin remains strong given institutional adoption trends and regulatory clarity progress.